Previously, the cost was $10 per credit bureau for every freeze/unfreeze.

#Credit freeze equifax free

It’s free and lasts 1 year.One of the most vital steps you can take toward protecting yourself from identity theft is to obtain a credit freeze. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 2 years. Place when you’re on active military duty. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years. Place when you’ve had your identity stolen and completed an FTC identity theft report at or filed a police report. It makes it harder for someone to open a new credit account in your name. Place when you’re concerned about identity theft. To sign up, contact each of the three credit bureaus - Equifax, Experian, and TransUnion. The credit bureau you contact must tell the other two to place an active duty fraud alert on your credit report.įree credit monitoring for active duty service membersĪctive duty service members can get free electronic credit monitoring, which can detect problems that might be the result of identity theft.

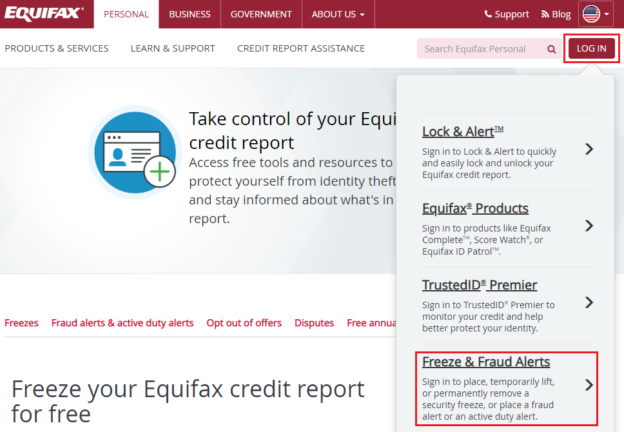

#Credit freeze equifax how to

How to place: Contact any one of the three credit bureaus - Equifax, Experian, and TransUnion. After a year, you can renew it for the length of your deployment. In addition, the credit bureaus will take you off their marketing lists for unsolicited credit and insurance offers for two years, unless you ask them not to.ĭuration: An active duty fraud alert lasts one year. A business must verify your identity before it issues new credit in your name.

What it does: An active duty fraud alert will make it harder for someone to open a new credit account in your name.

Who can place one: Active duty service members can place an active duty fraud alert. The credit bureau you contact must tell the other two to place an extended fraud alert on your credit report. In addition, the credit bureaus will take you off their marketing lists for unsolicited credit and insurance offers for five years, unless you ask them not to.ĭuration: An extended fraud alert lasts seven years. When you place an extended fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus twice within one year from when you place the alert, which means you could review your credit report six times in a year. A business must contact you before it issues new credit in your name. What it does: Like a fraud alert, an extended fraud alert will make it harder for someone to open a new credit account in your name. Who can place one: An extended fraud alert is only available to people who have had their identity stolen and completed an FTC identity theft report at or filed a police report. The credit bureau you contact must tell the other two to place a fraud alert on your credit report. When you place a fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus.ĭuration: A fraud alert lasts one year. What it does: A fraud alert will make it harder for someone to open a new credit account in your name. Who can place one: Anyone who suspects fraud can place a fraud alert on their credit report. Fraud Alertsįraud alerts are available in different situations and have different benefits. How to place: Contact each of the three credit bureaus - Equifax, Experian, and TransUnion. When the freeze is in place, you will still be able to do things like apply for a job, rent an apartment, or buy insurance without lifting or removing it.ĭuration: A credit freeze lasts until you remove it. You can temporarily lift the credit freeze if you need to apply for new credit.

What it does: A credit freeze restricts access to your credit report, which means you - or others - won’t be able to open a new credit account while the freeze is in place. Who can place one: Anyone can freeze their credit report, even if their identity has not been stolen.

0 kommentar(er)

0 kommentar(er)